How to Invest ₹100 in Digital Gold in India 2025

If you are a student, fresher, or just starting your financial journey, you might be thinking, Can I really start investing with just ₹100? yes, you can.

We’ll show you how to invest in digital gold in India, even if you’re starting with a small amount like ₹100. You don’t need a demat account, a financial background, or a ton of money. All you need is a smartphone, a UPI app, and a little curiosity.

👉If you haven’t started saving yet, begin with this simple guide on How to Start Budgeting Without Any Income

Digital gold is a modern way to own gold without actually buying or storing physical gold. It’s safe, easy, and perfect for beginners who want to start small and learn smart money habits early.

Let’s start by understanding what digital gold really is and how it works.

What Is Digital Gold and How Does It Work?

Digital gold is a way to buy real gold online, without needing to go to a jewelry shop or worry about storing it safely. When you invest in digital gold, you’re actually buying pure 24K gold, and it’s stored securely on your behalf by trusted companies.

It’s a great option for beginners who want to start investing in gold without big money or hassle.

Here’s how it works:

- You buy gold for as little as ₹10, ₹100, or any small amount.

- The platform buys that exact value of gold in grams (even 0.01 gram).

- Your gold is stored safely in insured vaults by the provider (like MMTC-PAMP, SafeGold, or Augmont).

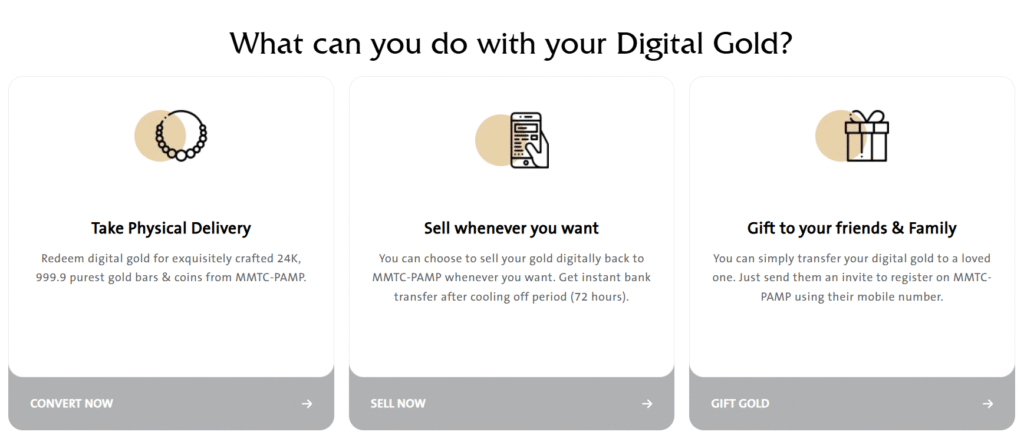

- You can sell it anytime or convert it into physical gold (jewelry or coins).

If you’re just starting your investing journey, this is one of the easiest ways to understand how to invest in digital gold in India because it’s flexible, low-cost, and 100% online.

No need to visit banks, open investment accounts, or understand the stock market. Digital gold makes gold investing possible for everyone, even if you’re just using your phone and ₹100.

Why Digital Gold Is a good Choice for Small Investors

You might feel like gold is out of your budget because it is costly. But digital gold changes that, it’s made for small, flexible investments that grow over time.

Here is why digital gold is a good choice:

✅ Start with just ₹100 — No need to save up thousands. You can buy a small piece of real gold without pressure.

✅ No storage stress — Your gold is stored in highly secure vaults. No locker, no fear of loss or theft.

✅ 100% purity and transparency — You’re buying 24K gold (99.9% pure) from trusted sellers, and you get a digital certificate too.

✅ Easy to sell or convert — You can sell your gold anytime online, or even convert it to physical gold if you want.

✅ Perfect for learning — It’s an ideal starting point for students to learn how investing works and how small, smart steps can lead to big gains later.

If you’re wondering how to invest in digital gold in India without risk or complexity, this is one of the safest and most beginner-friendly options available.

Think of it as a money habit not just a purchase. It trains you to save, invest, and build long-term value, even if you’re starting small.

Is ₹100 Enough to Start Investing in Gold?

Yes absolutely, You don’t need thousands to begin. In fact, learning how to invest in digital gold in India with just ₹100 is one of the best ways to start your financial journey as a student or beginner.

Here’s why ₹100 is more powerful than it looks:

You build the habit, not just the investment

It’s not about the amount, it’s about getting started. That ₹100 helps you understand how digital gold works, how buying/selling is done, and how investments grow.

No minimum limits on major platforms

Popular apps like PhonePe, Paytm, and Groww allow you to invest in digital gold starting at just ₹1. So ₹100 is more than enough to get going.

Small steps add up over time

Imagine investing ₹100 every month. That’s ₹1,200 a year and with gold prices rising steadily, your investment will grow too. It’s a slow, steady way to build wealth.

Makes investing feel real

For many students, the idea of investing feels distant. But putting in ₹100 and seeing your gold balance increase makes it real and exciting.

So yes, ₹100 is not just enough, it’s the perfect amount to begin. The goal is to get started and learn. And learning how to invest in digital gold in India with small amounts gives you experience, confidence, and long-term gains.

Best Platforms to Buy Digital Gold in India

If you’re just starting out, the good news is you don’t need to visit a bank or buy physical gold to begin. There are simple and trusted apps where you can buy digital gold in just a few taps.

Here are some of the most beginner-friendly and popular platforms in India:

🟢 PhonePe

- Easy to use, especially if you already use it for UPI payments.

- You can start with as little as ₹1.

- Gold is stored safely in a digital locker (vault) with MMTC-PAMP or SafeGold.

🔵 Paytm

- Offers real-time gold prices and a simple interface.

- Allows you to buy, sell, or even get gold delivered to your home.

- No need for a bank account — your Paytm wallet is enough.

🟢 Google Pay (GPay)

- Trusted platform with secure payment options.

- Lets you invest in gold linked to SafeGold.

- You can also sell your gold anytime and the amount goes to your bank.

🟣 Groww

- Great for students who also want to explore stocks and mutual funds later.

- Allows small investments in gold with a simple, modern interface.

- Gives a clear breakdown of your gold value and purchase history.

🔵 Tata Neu App

- Offers digital gold with real-time pricing and high trust factor.

- Backed by Tata Group, which adds credibility and brand confidence.

What to Look in a Good Platform

- Security – Make sure the gold is stored in a secure vault.

- Transparency – Real-time pricing with no hidden charges.

- Ease of Use – Simple interface and flexible investment options.

- Redemption Options – Ability to sell or convert to physical gold.

Starting with a trusted platform makes your investing journey smoother and safer. Choose one that fits your comfort most of these apps don’t even need KYC for small amounts.

Common Mistakes to Avoid When Buying Digital Gold

When you’re starting with small amounts like ₹100 or ₹500, every rupee counts. That’s why avoiding common mistakes is just as important as choosing where to invest. If you’re learning how to invest in digital gold in India, it’s crucial to understand what not to do from the beginning. Here are a few things beginners often do wrong and how you can do better.

1. Buying Without Checking the Price

Digital gold prices change throughout the day, just like stock prices. Some people buy at random times without checking whether the price is high or low.

Tip: Always check the live gold rate on your app before buying. If prices are too high, wait for a dip.

2. Not Knowing Who’s Holding the Gold

Some platforms partner with trusted gold providers like MMTC-PAMP, SafeGold, or Augmont. Others might not be as reliable.

Tip: Always make sure your gold is held securely in a certified vault and backed by a well-known company.

3. Ignoring Small Charges

Even for digital gold, some apps add extra fees like GST, storage charges, or delivery fees (if you convert to physical gold). These can eat into your small investment.

Tip: Read the terms before buying. Look for platforms with low or no hidden charges for beginners.

4. Treating It Like a Get-Rich-Quick Trick

Gold is a long-term investment. Many beginners expect quick returns, but that’s not how gold works. It’s meant to grow slowly and protect your money over time.

Tip: Be patient. Use digital gold as part of your savings not a shortcut to instant profit.

5. Forgetting to Track It

Some people buy gold once and forget about it, no follow-up, no tracking.

Tip: Use a notes app or your investment app’s tracking features. Check in monthly to see how your gold is doing and decide if you want to add more.

Avoiding these simple mistakes will help you get the most out of your money as you learn how to invest in digital gold in India. Think of it like building good habits now the smart way to grow wealth over time.

Is Digital Gold Safe and Legal in India?

If you’re new to investing, especially as a student or first-time saver, it’s natural to ask: “Is digital gold really safe?” or “Is it even legal in India?”

Yes, Digital Gold Is Legal in India. Digital gold is 100% legal and regulated through trusted companies like:

- MMTC-PAMP (a government-authorized refinery)

- SafeGold

- Augmont

These companies follow strict security and quality standards and partner with well-known apps like PhonePe, Paytm, Groww, and more. Even though there’s no direct SEBI regulation (like in stocks), these platforms operate under strong industry checks and storage policies.

Is It Actually Safe?

Yes, the digital gold you buy is fully backed by real physical gold. For every rupee you invest, there’s equal weight in gold stored safely in a certified vault.

- You can check your balance anytime in the app.

- You can convert digital gold to real gold (coins/bars) if needed.

- You can sell it anytime, 24/7.

Final Thought

If you’re wondering how to invest in digital gold in India safely, the answer is simple: stick with reliable platforms, stay informed, and invest with a long-term mindset. Digital gold is a modern, flexible way to build your savings, even with just ₹100.

👉 Check out our beginner-friendly guide on Best AI-Powered Investing Tools for Beginners in India (2025)