How to Invest in Accenture Stock from India (2025 Beginner’s Guide)

Have you ever wondered if you could invest in global companies like Accenture while sitting right here in India? You’re not alone. With growing interest in international stocks, many Indian investors particularly young professionals and students are seeking to explore opportunities beyond the Indian market. And Accenture, being a global IT consulting giant, is often at the top of that list.

If you have been asking yourself how to invest in Accenture stock from India, this guide is for you.

I’ll walk you through everything you need to know from how to start, which apps or brokers to use, what rules you should be aware of, and how much money you need. Whether you’re a complete beginner or someone looking to diversify your investments, this article is designed to help you make confident and informed decisions without all the jargon.

Let’s break it down step by step, in a way that’s easy to understand and practical to follow.

How to Buy Accenture Shares from India: Step-by-Step Guide

Investing in global companies like Accenture (Ticker: ACN) might sound complicated, but honestly, it’s become a lot easier in recent years thanks to modern apps and platforms designed for Indian investors. Below is a step-by-step guide that anyone, even a beginner, can follow:

Step 1: Choose a Platform That Lets You Invest in US Stocks

In India, you can’t directly open a US stock brokerage account like an American citizen. But don’t worry, there are SEBI-registered apps and brokers that partner with international platforms to let you legally invest in stocks like Accenture.

Here are some popular options for Indian users:

1. INDmoney – User-friendly and offers fractional shares

2. Vested – Great for beginners, offers curated portfolios too

3. Groww – Has added US stock investing with a simple UI

4. Stockal – Focused on global investing with research tools

5. Cube Wealth, Winvesta – Also offers access to US stocks

Choose the one that suits your style. If you like a clean app with low fees and simple dashboards, INDmoney and Vested are solid picks for beginners.

Step 2: Complete Your KYC and Open Your Global Investing Account

Once you download the app or sign up on their website, you’ll need to complete KYC (Know Your Customer) just like you would when opening a bank account.

You’ll typically need:

- PAN Card

- Aadhaar Card or Passport

- A selfie (for verification)

- Bank account details (for funding your account)

The process is digital and usually takes 10–24 hours for approval.

Step 3: Add Funds to Your US Stock Account (Using INR)

Now comes the part that’s a bit technical, sending Indian Rupees (INR) to a US account. This is done under the RBI’s Liberalized Remittance Scheme (LRS), which allows Indians to send up to $250,000 per year abroad legally.

You don’t need that much. Even ₹1,000–2,000 is enough to start.

How this funding works:

- The app (e.g., Vested or INDmoney) gives you a local partner bank account to deposit INR

- Your money gets converted to USD and added to your US stock wallet

- Usually takes 1–2 working days

Some banks charge foreign remittance fees (approximately ₹500–₹1000) plus GST, as well as foreign exchange conversion charges (around 1%). Always check before you transfer.

Step 4: Search for “Accenture” or Ticker Symbol “ACN”

Once your account is funded in USD, go to the search bar of your chosen platform and type: Accenture or ACN (its stock symbol on the NYSE)

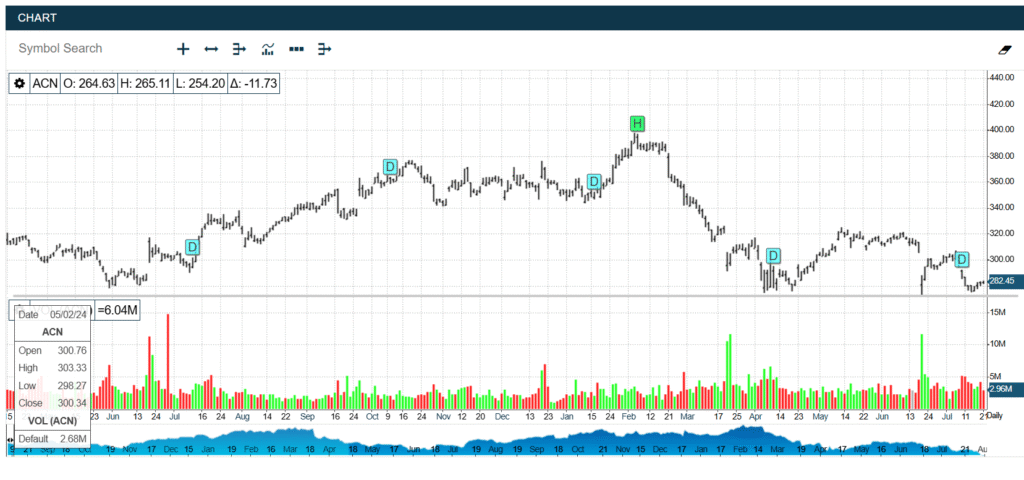

You’ll see live stock prices, charts, company info, and options to invest.

Step 5: Buy Full or Fractional Shares (Start with Even $5!)

Here’s the best part: You don’t need to buy 1 full Accenture share (which might cost $300+). These platforms allow fractional investing, so you can buy just $5 or $10 worth of a share if you want.

- Enter the amount in USD (e.g., $10)

- Preview your order

- Hit Buy and confirm

- Boom! You now own a part of Accenture 🎉

Step 6: Track Your Investment and Learn as You Go

You can now:

- Monitor the stock price inside the app

- Set alerts (e.g., if Accenture hits a certain price)

- Read financial updates and earnings reports

- Slowly build your global portfolio

Pro Tip: Start small and add more only after understanding the risks. US stocks can be volatile, and there’s also currency risk (INR–USD).

👉want to invest in Digital gold, check our full guide on: How to Invest in Digital Gold in India 2025

Things to Keep in Mind Before Investing in Accenture

Investing in a global company like Accenture sounds exciting, and it is! But before you hit that “Buy” button, here are a few practical things to consider. These tips will help you invest smarter, avoid mistakes, and feel more confident as you build your portfolio.

1. Currency Risk Is Real

Accenture stock is traded in US Dollars (USD). So when you invest from India, you’re also indirectly betting on the USD–INR exchange rate.

- If the rupee weakens, your returns may grow (even if the stock price stays the same)

- If the rupee strengthens, it might reduce your profit

Keep an eye on currency trends and avoid panic buying or selling during sudden forex fluctuations.

2. Stock Prices Go Up and Down

Accenture is a strong company, but no stock is risk-free. Its price can drop due to global market corrections, quarterly results, or changes in business demand.

Don’t invest money you might need in the next 6–12 months. Think long-term and stay calm during dips.

3. You’ll Pay Fees and Forex Charges

While most apps advertise “zero commission,” there are still hidden costs like:

- Forex conversion fee (usually 1–1.5%)

- Bank remittance charges (₹500–1,000 per transfer)

- Annual maintenance or withdrawal fees on some platforms

Tip: Compare platforms and read the fee structure before sending money.

4. US Dividend Tax Withholding Applies

If Accenture pays a dividend, the US government will withhold 25–30% as tax. However, you can claim credit for this when filing your Indian income tax return under the DTAA (Double Taxation Avoidance Agreement).

How to track Accenture share price using AI stock apps in India

Once you’ve invested in Accenture, or even if you’re just planning to keep an eye on the stock’s performance, it is super important. The good news? You don’t need to manually check U.S. stock exchanges every day. There are smart AI-powered apps in India that can do the work for you.

Let’s look at how you can track Accenture (ACN) share price easily and intelligently using AI stock apps.

1. Use INDmoney – Smart Alerts + AI Tracking

INDmoney is one of the most beginner-friendly platforms for Indian investors in U.S. stocks. It uses AI to help you make informed decisions.

Features:

- Real-time Accenture share price in INR & USD

- Smart AI insights like: “Stock is overvalued/undervalued”

- Portfolio health check and diversification suggestions

- Get price alerts and AI-driven reports based on your holdings

2. Track on Vested – AI Score + Stock Watchlist

Vested offers an “AI Stock Score” based on various indicators like valuation, growth, and financial health.

How it helps:

- Add Accenture (ACN) to your watchlist

- Get notified about key movements or earnings

- Use their AI-driven research to understand the stock’s strength

3. Use Stockal – AI-Backed Research Tools

Stockal gives access to institutional-grade research using AI and data analytics.

You can:

- Set alerts for Accenture’s stock movements

- Read AI-curated news and reports related to Accenture

- Track your investment with detailed breakdowns

4. Use TickerTape or Trendlyne for Data Insights (Optional Tools)

While these platforms are more India-focused, they sometimes cover U.S. stock data too. They use AI to show:

- Price trends and charts

- Technical analysis (simple for beginners)

- Market sentiment indicators

5. Set Up Smart Alerts & Auto Reports

Most AI apps allow you to set:

- Daily or weekly performance updates

- Price change alerts (e.g., if ACN falls 5%)

- Earnings call summaries

- Dividend alerts

Summary: Best AI Apps to Track Accenture Stock

AppKey AI Features Good For

INDmoney AI alerts, insights, INR-based tracking, Beginners, auto reminders

Vested AI stock score, US-focused research, and Planning investments

Stockal Pro-level AI research, curated news, and Advanced learners

👉Check our full guide on: How to Use AI investing tools for students in 2025 | Simple Guide

Tips for First-Time US Stock Investors from India

So you’re ready to step into the world of global investing. But before you go all in, here are some practical and beginner-friendly tips to help you stay on the right track as a first-time U.S. stock investor from India.

These aren’t just technical tips, they’re real-world advice you’ll wish someone had told you earlier.

1. Start Small and Learn as You Go

Don’t rush. You don’t need to invest ₹50,000 on day one. Start with a small amount, maybe ₹1,000 to ₹5,000. Just to get a feel of how global investing works.

2. Understand What You’re Buying

Just because Accenture or any U.S. stock is popular doesn’t mean it’s the right fit for you. Read about the company, understand its business model, and ask yourself:

3. Don’t Ignore Currency Exchange Rates

Since you’re investing in dollars, keep an eye on the INR–USD rate. Over time, currency fluctuations can impact your returns, both positively and negatively.

5. Use AI Tools, But Don’t Depend on Them Blindly

AI stock apps like INDmoney, Vested, and Stockal give great insights, but they’re not fortune tellers. Use their suggestions as support, not as guarantees.

Final Thought

Investing in U.S. stocks like Accenture from India is not just for the rich or finance experts anymore. With the right tools, a cautious mindset, and consistent learning, even a college student or young professional can start building global wealth, one smart decision at a time.

Take your first step today, not because it’s trendy, but because your future self will thank you.