Best AI Budgeting Apps for Students in 2025

As all of you know, managing money in college is not easy with tuition fees, rent, weekend outings, and random Zomato cravings, your wallet can feel constantly under pressure. But 2025 has brought smart solutions with AI-powered budgeting apps, which are specifically designed for students.

These are not boring spreadsheets. These apps track your spending automatically, send you alerts before you overspend, and even help you plan for goals, all with the help of artificial intelligence.

As a student myself, I tested several popular apps to find the most useful ones for student life in India and globally. Whether you are trying to save for a trip or just avoid running out of cash mid-month, here are the top 5 AI budgeting apps worth trying in 2025.

Top 5 Best AI Budgeting Apps for Students in 2025

1. Cleo

Cleo is not your typical finance app, it feels more like chatting with a funny, brutally honest friend who wants to fix your spending habits. Using AI and chat-based interactions, Cleo helps you manage your budget without making it boring.

What It Does:

- Connects to your bank account

- Breaks down your spending by category

- Sends money-saving tips via chat

- Features Roast and Hype modes for motivation

Why It is Great for Students: When I went overboard with online food orders during finals, Cleo roasted me: “You have spent ₹1,200 on snacks this week. Your wallet is crying.” That notification alone got me to start meal prepping. Cleo is fun, free, and effective, though advanced features require Cleo+.

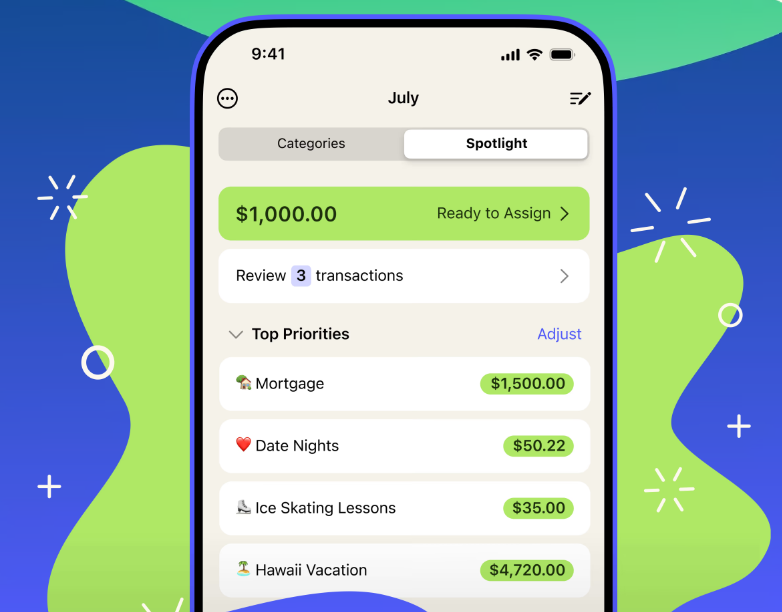

2. YNAB (You Need A Budget)

If you want a strict budgeting system with full control over every rupee, YNAB is a great choice. Its AI-powered analytics help you plan and adjust based on your habits.

What It Does:

- Follows a zero-based budgeting method (every rupee gets assigned a purpose)

- Syncs with your bank accounts

- Tracks goals like rent, textbooks, and emergency funds

- Offers educational content to improve money habits

Student Perks: YNAB offers free trials and student discounts. It takes effort to set up but pays off if you stick to it.

3. Mint

Mint is one of the most well-known money apps, now upgraded with smarter AI tools. It pulls all your financial info into one place and gives you real-time insights.

What It Does:

- Syncs with your bank and credit accounts

- Sends personalized alerts when you overspend

- Tracks bills, subscriptions, and savings goals

- Offers budgeting recommendations

Why Students Like It: It’s completely free and easy to use. I liked how Mint reminded me of my phone bill 2 days before the due date, no more late fees.

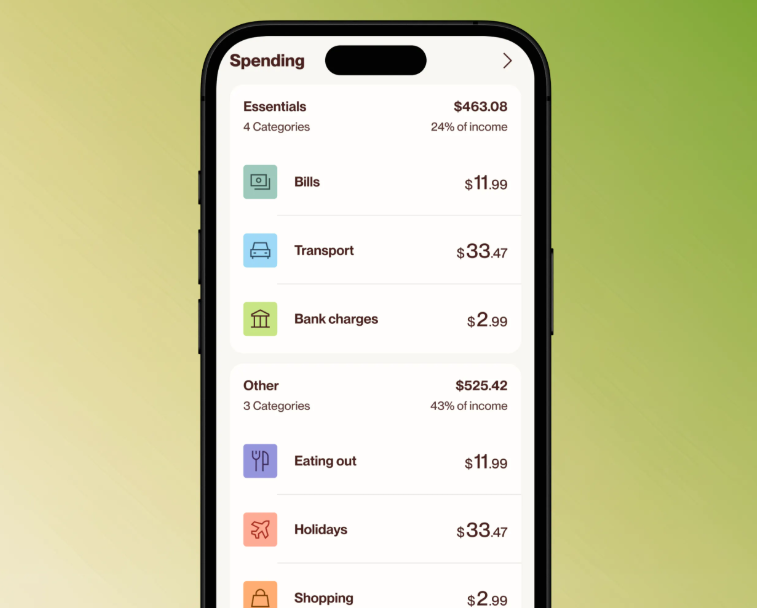

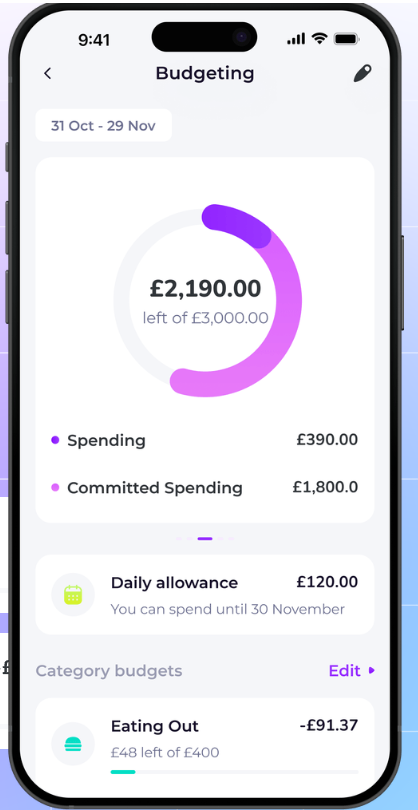

4. Emma

Emma calls itself a money “super app” and it’s especially useful if you keep forgetting to cancel free trials. It uses AI technology to highlight areas where you are overspending.

What It Does:

- Spots and helps cancel unwanted subscriptions

- Shows real-time spending insights

- Offers saving tips and alerts

- Lets you categorize purchases easily

Bonus for Students: Emma’s free version works well, but the paid version includes cashback offers and deeper analysis.

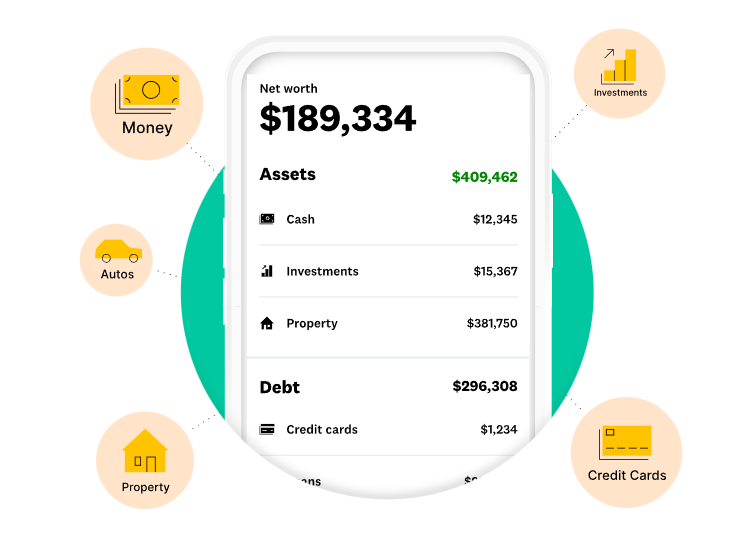

5. PocketGuard

PocketGuard is perfect for students who want to avoid overdrafting. It focuses on showing you what you can safely spend after your bills, goals, and savings.

What It Does:

- Syncs with your bank accounts and bills

- Shows your “safe to spend” number in real-time

- Tracks spending habits with AI

- Suggests budget improvements

Why I Recommend It: It helped me realize I could only afford 2 movie nights a month, not 4, a game-changer for my wallet.

let us compare these AI budgeting apps.

Comparison Table of AI Budgeting Apps

| App | Best For | Free Version | Student Discounts | Unique Feature | India-Friendly? |

|---|---|---|---|---|---|

| Cleo | Fun, chat-based budgeting | ✅ Yes | ❌ Not advertised | AI roasts and motivation modes | Yes (limited) |

| YNAB | Strict zero-based planning | ✅ Trial only | ✅ Yes | Goal-focused budgeting philosophy | Yes |

| Mint | All-in-one tracking | ✅ Yes | ❌ Not specific | Personalized bill reminders | Yes (basic) |

| Emma | Managing subscriptions | ✅ Yes | ❌ Not specific | Subscription detection + cashback | Yes |

| PocketGuard | Safe spending planning | ✅ Yes | ❌ Not mentioned | “Safe to spend” balance | Limited |

How to Choose the Best AI Budgeting App for You

To choose the best AI budgeting app, start by asking yourself what you really need because every student’s financial situation is unique.

1. Do you prefer a fun approach or strict control?

- For a lighthearted, chatbot-style experience, try Cleo.

- For disciplined, hands-on budgeting, go with YNAB (You Need A Budget).

2. Struggling with unused subscriptions?

- Try Emma, makes it super easy to spot and cancel them.

3. If everything want in one place?

- Try Mint, it gives you a complete view of your finances in a single dashboard.

4. Just need to know your spending limit?

- Use PocketGuard, it quickly tells you how much you can safely spend.

But before using these apps, check if the app:

- Has a free plan that’s genuinely useful

- Supports Indian banks or UPI (if you’re in India)

- Offers student discounts to save you extra money

FAQ

Q: What is the best free AI budgeting app for students?

Cleo, Mint, and Emma offer solid free plans that cover essential features. Pocket Guard also has a strong free version.

Q: Is it safe to link my bank account to these apps?

Yes, reputable apps use bank-level encryption and are trusted by millions. Still, always read user reviews before installing.

Q: Can I use these apps if I don’t have a fixed income yet?

Absolutely. You can track allowances, part-time earnings, and expenses to still build good money habits.

Q: Which apps work best in India?

Mint and Emma support global use, but some features (like UPI integration) may be limited. Always check app availability in your region.

Final Thoughts

Budgeting doesn’t have to be stressful or boring. With the right AI budgeting app, students can take control of their finances, save smarter, and avoid unnecessary anxiety.

Start small, pick one app, test it for a week, and see what changes. Your future financially savvy self will thank you.

👉Check out this also: How to Use AI investing tools for students in 2025 | Simple Guide